When Platform Partners Become Platform Problems: The $5.4B Windsurf Breakdown

Anatomy of a Failed Deal

Three findings from tracking the OpenAI-Windsurf acquisition collapse—and one unresolved question about partnership agreements in AI. After six months of watching this deal unfold, here's what works differently when your biggest asset becomes your biggest constraint.

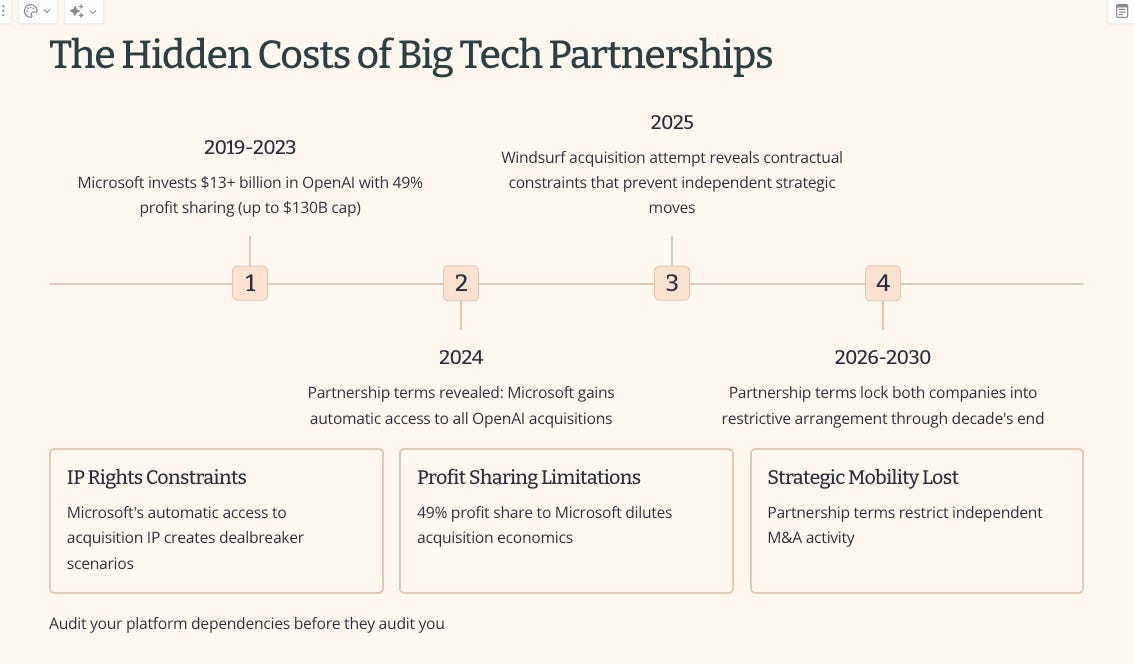

Microsoft's contractual IP rights killed OpenAI's $3 billion Windsurf acquisition in July 2025, clearing the path for Google's $2.4 billion talent grab. The combined $5.4 billion in deal activity around a single AI coding startup reveals how partnership agreements designed for one competitive era can become strategic handcuffs in the next. For technical business leaders, this breakdown exposes platform dependency risks that most teams haven't adequately planned for.

The anatomy of a partnership problem

OpenAI discovered their Microsoft alliance had teeth. Under their 2023 partnership agreement, Microsoft holds automatic rights to any IP that OpenAI acquires—a provision that seemed reasonable when OpenAI needed capital and computing resources. That clause proved fatal when Microsoft realized Windsurf would directly compete with GitHub Copilot's $400 million ARR business.

The timeline tells the story. February 2025: Windsurf raising funds at $2.85 billion valuation with $40 million ARR. April: ARR hits $100 million—a 150% increase in two months that caught OpenAI's attention. May: OpenAI offers $3 billion, representing a 75x revenue multiple that reflected strategic necessity rather than financial fundamentals. July: Deal collapses when Microsoft's legal team examines the implications.

Microsoft's position made business sense. Their GitHub Copilot serves 15 million users with 400 million completion requests daily. Allowing OpenAI to acquire Windsurf would effectively hand their competitor their own rival's technology. OpenAI refused to grant Microsoft access to Windsurf's IP. Windsurf's CEO reportedly opposed any Microsoft involvement. By July 11, the exclusivity period expired with no resolution.

Google's response demonstrated strategic timing worth studying. Within hours of the OpenAI deal's collapse, they announced a $2.4 billion arrangement to hire Windsurf's CEO, co-founder, and select R&D staff for DeepMind while securing non-exclusive technology licenses. This "reverse acqui-hire" structure captured Windsurf's strategic value while avoiding regulatory scrutiny that a full acquisition would trigger.

The remaining company continues operating with 250 employees under interim CEO Jeff Wang. Its competitive position remains uncertain without founding leadership.

Platform dependency as existential risk

Anthropic's calculated move to cut Windsurf's Claude model access in May added strategic complexity. Co-founder Jared Kaplan's assessment—"I think it would be odd for us to be selling Claude to OpenAI"—demonstrates how model access has become a competitive weapon. This forced Windsurf onto more expensive third-party inference providers, potentially contributing to their acquisition openness.

For Anthropic, the move signaled transition from neutral model provider to active competitor developing Claude Code products. For Windsurf, it exposed the platform dependency risk that most AI tools companies face but few adequately address.

The market responded decisively. Cursor, Windsurf's primary competitor, raised $900 million at a $9.9 billion valuation shortly after acquisition news broke. Their $500 million ARR and 60% month-over-month growth demonstrate that markets reward perceived stability and independence. Other AI coding startups now face a clear choice: seek acquisition by a large platform or build sufficient scale for independence.

Working with teams implementing AI coding tools, I've observed this vulnerability firsthand. Teams building on third-party AI models face sudden access termination, pricing changes, or capacity constraints that can cripple operations overnight. A Forrester survey found that only 43% of developers fully trust AI-generated code accuracy, while 65% report that AI tools "miss relevant context" during critical tasks like refactoring. The combination of quality concerns and platform instability creates operational risk that most organizations haven't systematically addressed.

The acqui-hire playbook emerges

Google's $2.4 billion Windsurf arrangement follows a pattern: Google's $2.7 billion Character.AI deal, Microsoft's $650 million Inflection hiring, Amazon's Adept acquisition. These structures avoid triggering Hart-Scott-Rodino Act reporting requirements for mergers above $119 million while securing AI capabilities.

The legal innovation is worth understanding. No equity changes hands, target companies remain nominally independent, and technology stays available for licensing to others. Regulators struggle to prove anticompetitive effects when deals are structured as separate employment agreements combined with non-exclusive technology licenses.

DOJ has opened investigations into these arrangements. Assistant Attorney General Jonathan Kanter notes they may be "acquisitions in all but name." FTC Chair Lina Khan expresses concern that they "risk distorting innovation and undermining fair competition." Current antitrust frameworks appear inadequate to address this evolution.

For AI startups, this creates a paradox. Traditional exits through IPOs or acquisitions face barriers—aggressive antitrust enforcement blocks standard M&A while few AI companies reach sufficient scale for public markets. The acqui-hire model offers viable returns to investors and soft landings for founders, but dismantles promising independent companies.

Venture capitalists report that 42% of all US venture investment now flows to AI companies, but exit uncertainty dampens valuations and extends investment horizons.

Three strategic lessons for technical leaders

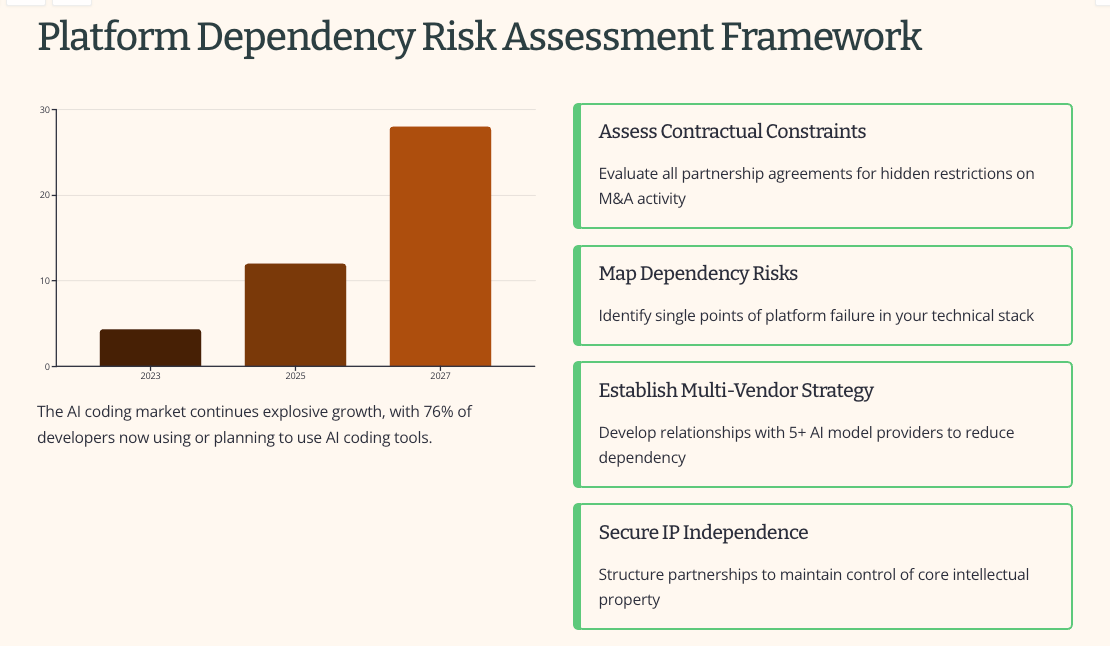

Partnership agreement review matters more than most teams realize. OpenAI's constraint didn't emerge from poor negotiation—it reflected reasonable terms for their situation in 2023. But competitive landscapes change faster than legal agreements. Technical leaders should audit existing partnership agreements for constraints that could limit future strategic options.

Current evidence suggests that agreements granting automatic IP access, exclusive technology rights, or competitor approval mechanisms may prove restrictive as markets mature. Teams need periodic legal review of partnership terms alongside technology architecture decisions.

Multi-vendor strategies aren't just about cost optimization. Platform dependencies create sudden operational risks that can't be solved through better SLAs or contract terms. The most resilient implementations actively manage vendor concentration through technical architecture decisions and operational procedures.

Microsoft Azure CTO Mark Russinovich's warning carries new weight: current AI coding tools "can't handle complex software projects and suffer from reliability issues." When vendors can lose model access without warning, reliability extends beyond code quality to platform stability.

Market consolidation acceleration affects procurement timelines. The premium valuations—Windsurf at 75x ARR, Cursor at nearly 20x—reflect strategic value rather than financial fundamentals. Today's innovative startup may be tomorrow's acqui-hire casualty. Vendor evaluation requires continuous assessment rather than annual reviews.

Organizations now use an average of five or more AI models, up from 29% to 37% year-over-year, specifically to avoid single points of failure. The shift from innovation budgets to core IT spending for AI tools—dropping from 25% to just 7% allocated from innovation funds—signals that these technologies have moved from experimental to essential.

The unresolved question

Platform providers can weaponize model access. Large technology companies can circumvent antitrust restrictions through creative deal structures. Partnership agreements can become strategic constraints. The question: Will the AI ecosystem's promised democratization survive these consolidation pressures?

Current evidence suggests concentration rather than distribution. The AI coding tools market exploded from $4.3 billion in 2023 to an estimated $12 billion in 2025, with projections reaching $25-30 billion by 2027. But these numbers reflect fundamental changes in software development controlled by fewer players—76% of developers now use or plan to use AI-assisted coding tools, up from 70% last year.

If this pattern continues, technical leaders must prepare for a market where strategic flexibility depends more on independence from platform dependencies than on tool capabilities. Implementation depends on your specific context, particularly existing platform dependencies and risk tolerance.

The Windsurf breakdown represents more than a failed acquisition—it's a preview of how competitive dynamics will unfold as AI infrastructure matures. Success requires understanding not just what tools can do, but the complex web of dependencies, partnerships, and competitive relationships that determine their long-term viability.

Current evidence points toward increased consolidation, though regulatory responses could affect outcomes significantly. Worth monitoring how other partnership-constrained companies navigate similar strategic decisions as the AI tools market races toward its projected $25-30 billion valuation.

By the way, don’t think Anthropic’s restricting of Claude models had an impact? Look at this press release from Codium:

The Windsurf IDE, now with full access to the latest Claude models