The First Shot: Google’s 10-Result Limit and the SAIO Wars

Search infrastructure becomes a competitive cudgel

“Google’s 10-result limit reveals something important about where we are in the AI transition. The company that defined modern search now views open access to that search as a competitive liability rather than an asset.”

Back in August, we mapped out how Brave Search was positioning itself as critical AI infrastructure in what we called the coming “SAIO” wars—Search AI Optimization battles that would reshape how AI systems access web content. We predicted Google would use its market dominance aggressively.

That prediction aged well. Google just fired the first shot.

A Quiet But Impactful Change

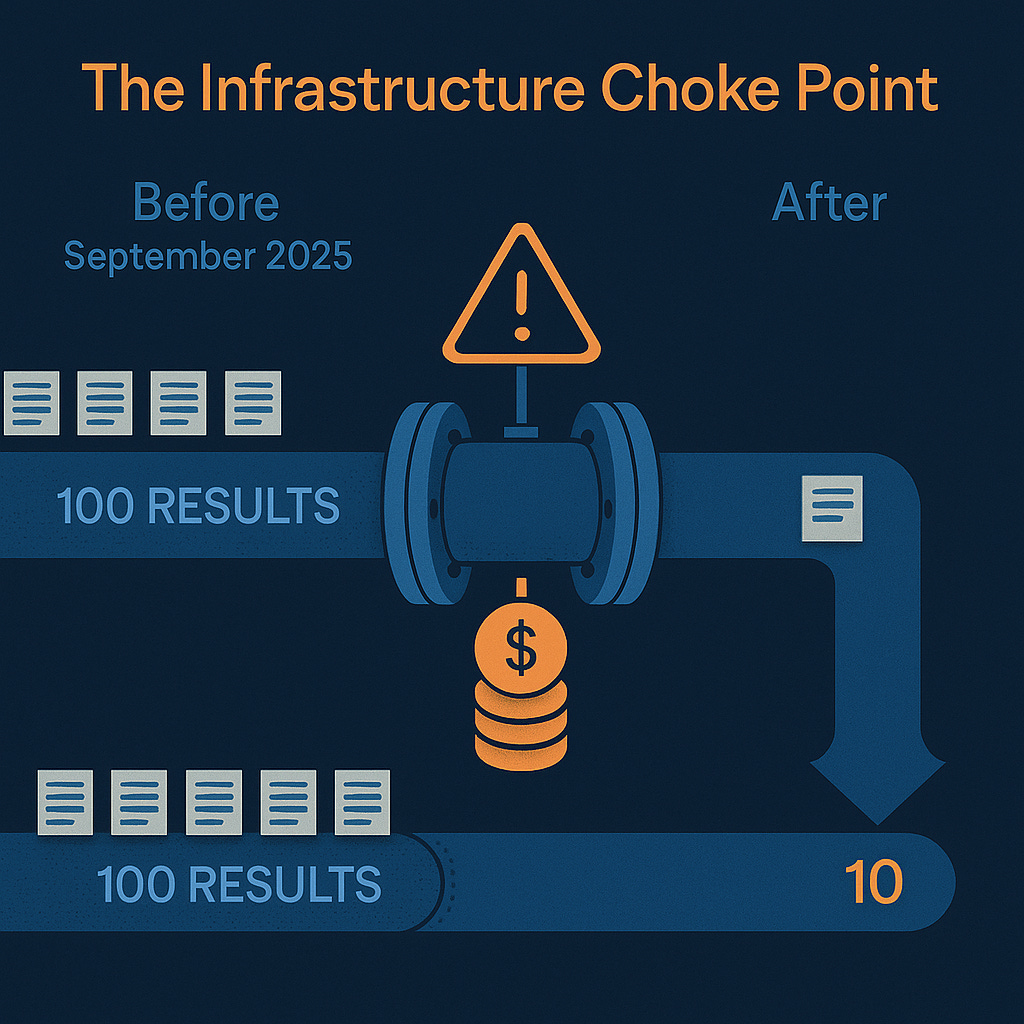

Mid-September 2025. Google disabled the &num=100 URL parameter that allowed users and tools to retrieve 100 search results per page. No announcement. No warning. Just a sudden shift from generous access to strict 10-results-per-page limits.

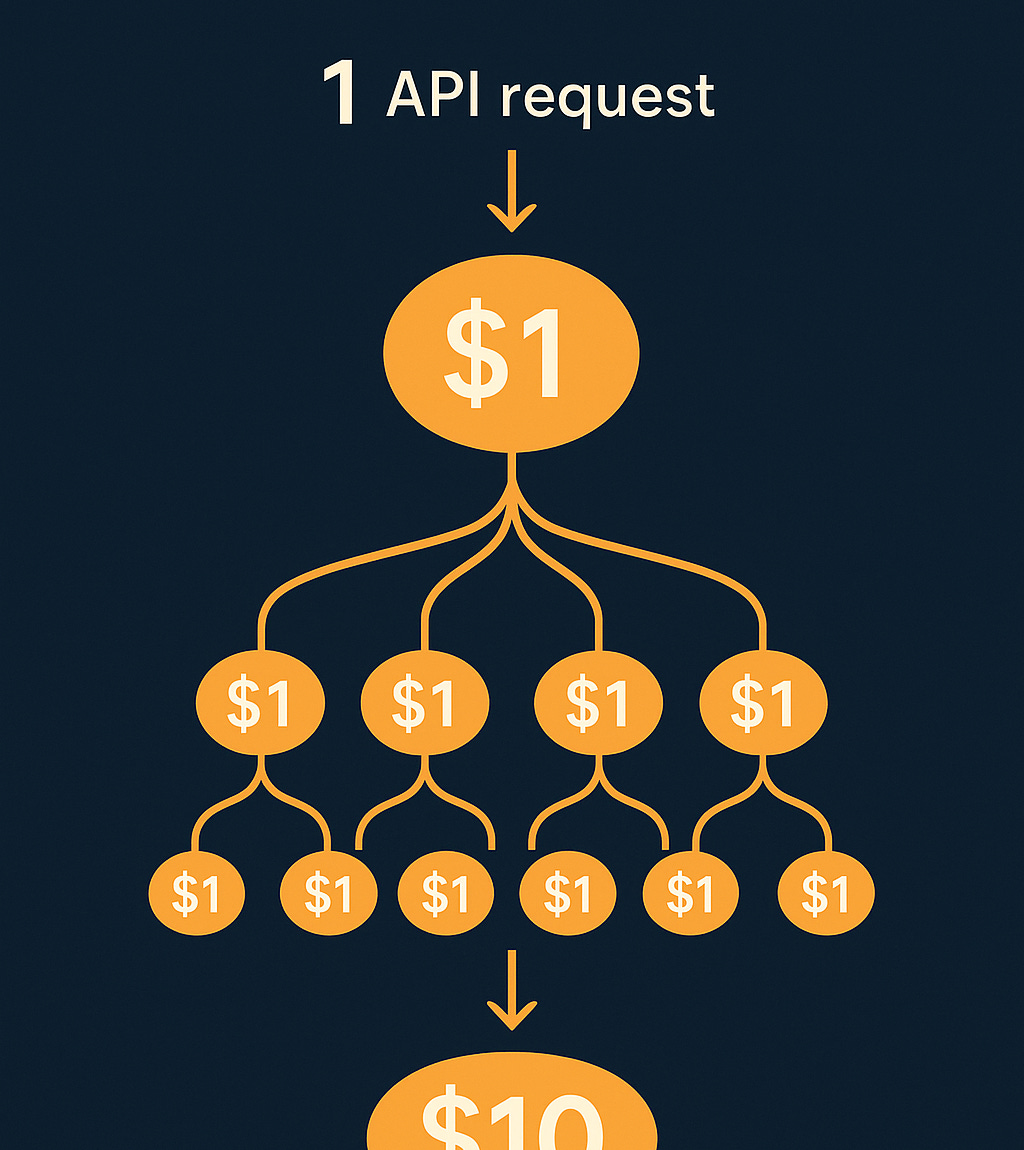

The immediate impact cascaded through the ecosystem. SEO tracking tools like Semrush and Ahrefs that previously pulled 100 results with a single API call now need 10 separate requests for the same data—a 10x cost increase overnight. AccuRanker announced it would no longer track top 100 results, capping at top 20 instead. According to TechWyse analysis, 77% of websites lost unique ranking terms visibility, while 87.7% saw impression declines in tracking systems.

The technical disruption is surface noise. This change targets a much bigger game.

Who Got Hit

On the surface, this looks like Google protecting infrastructure from scraping bots. Dig deeper and the strategic calculus becomes clear.

Content sites like Reddit took a body blow. Through 2025’s algorithm updates, Reddit lost 350 SISTRIX visibility points—roughly equivalent to losing the entire visibility of Home Depot’s website, according to SEO analyst Lily Ray. Google’s March 2025 Core Update had already started devaluing forum content after 18 months of elevated visibility. The 10-result limit compounds that pressure. When LLMs scraping Google results can only access the first page, content aggregators and discussion forums drop out of sight even faster.

Non-Google LLMs using Google search data face sudden friction. Reports from The Information in August revealed OpenAI was using SerpApi to scrape Google results for ChatGPT’s real-time queries. That scraping operation just became 10x more expensive and logistically complex. When ChatGPT exec Nick Turley testified during Google’s antitrust trial that Microsoft’s Bing had “significant quality issues,” he wasn’t subtle about ChatGPT’s dependence on Google’s superior index.

Try training or grounding an LLM when every data collection request multiplies by 10x. The infrastructure costs alone force recalculation.

Anthropic Benefits While Google Invests

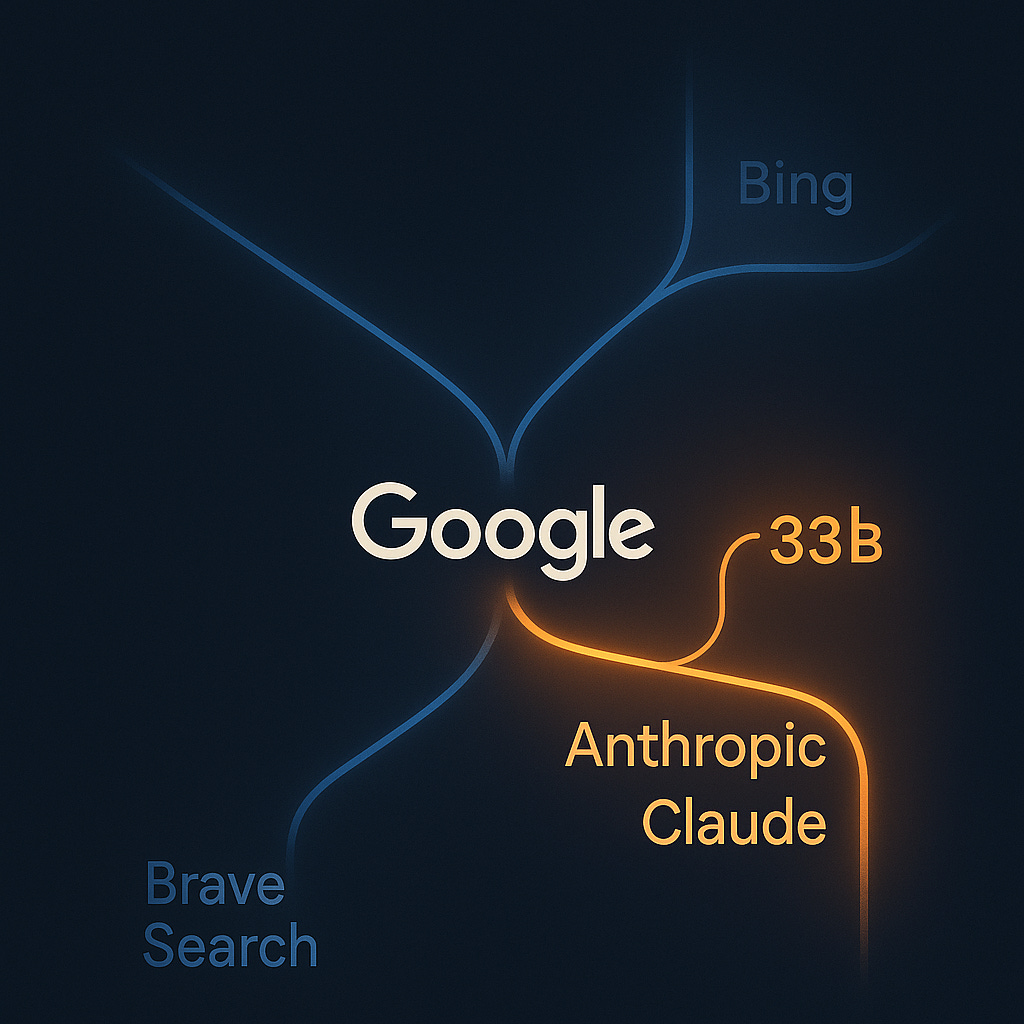

Notice who doesn’t get hurt by limiting Google search access? Anthropic’s Claude, which happens to have Google as a major investor.

Google invested over $3 billion in Anthropic as of March 2025, holding a 14% stake according to TechCrunch reporting. That January 2025 investment of $1 billion came on top of previous $2 billion commitments. Google owns more than a tenth of the company building Claude—the AI assistant that competes directly with ChatGPT.

When Google restricts access to its search infrastructure, OpenAI’s ChatGPT struggles with real-time data while Anthropic’s Claude benefits from Google Cloud infrastructure and implicit data advantages. It’s not conspiracy—it’s calculated competitive (monopolistic?) positioning.

The pattern echoes classic Big Tech playbooks. When Microsoft dominated PC operating systems, they had convenient “compatibility issues” with competing browsers. When IBM controlled mainframe computing, their software mysteriously performed better on IBM hardware. Now Google controls the world’s dominant search index while investing billions in an OpenAI competitor.

The Microsoft-IBM Playbook

Here’s where history provides uncomfortable parallels. When established tech giants face genuine innovation threats, they don’t compete purely on product merit. They use existing market dominance to tilt the playing field.

Microsoft spent years in antitrust court for bundling Internet Explorer with Windows, disadvantaging Netscape through distribution control rather than superior technology. IBM maintained mainframe dominance through strategic incompatibilities and lock-in, not because their systems were dramatically better than emerging alternatives.

Google now faces its own moment of market power vulnerability. Despite controlling 90%+ of search traffic, AI-powered alternatives threaten the business model. ChatGPT search could route users around Google entirely. Perplexity offers conversational answers without ad-laden results pages. The $200 billion advertising empire faces existential risk.

Rather than purely competing on AI product quality—where Google’s Gemini has struggled against ChatGPT —Google deploys the classic defensive move: control the infrastructure competitors need to operate.

Why Brave Search Matters Now

The 10-result limit makes Brave Search’s value proposition suddenly more compelling.

Brave operates a completely independent web index of over 30 billion pages, updated with 100 million new pages daily. Their Search API provides LLM access to search data without dependence on Google or Microsoft infrastructure. Pricing starts at $3 per 1,000 queries with generous free tiers—dramatically cheaper than navigating Google’s new restrictions.

Interesting detail: Brave doesn’t offer OAuth signups via Google. Wonder why? When you’re building infrastructure to compete with Google’s search dominance, you probably don’t want to depend on their authentication systems either.

In addition to Anthropic, companies like Cursor, Cline, and Windsurf already use Brave’s API to power AI chat experiences. As Brave’s documentation emphasizes, they’re “the only privacy-preserving and independent search index in the West” at scale. When Google and Microsoft both constrain access, Brave becomes critical infrastructure.

I just signed up for a Brave API key. Not because I love switching tools, but because depending on a single search provider in the SAIO era is strategic suicide. When the giant moves, you need alternatives ready.

Cracks Start at the Foundation

Google’s 10-result limit reveals something important about where we are in the AI transition. The company that defined modern search now views open access to that search as a competitive liability rather than an asset.

This defensive posture suggests vulnerability. Strong market leaders don’t suddenly restrict access to services competitors depend on unless they’re genuinely worried about those competitors. Google wouldn’t sabotage SEO tools and LLM developers if it felt confident in Gemini’s competitive position.

The cracks are forming at the foundation of search. When the dominant player starts limiting access, alternative infrastructure becomes necessary. Brave Search, independent indexes, and distributed approaches shift from interesting experiments to essential insurance.

We predicted Google would use its market dominance aggressively. The SAIO wars are accelerating, and we’re watching the opening gambits play out in real-time.

Watch who controls the search infrastructure your AI systems depend on. Companies that control search will increasingly use that control as competitive leverage. The race isn’t just about better AI models anymore—it’s about who owns the data pipelines feeding those models.

And right now, Google just made that pipeline a lot narrower for everyone except its chosen partners.

Related reading: Brave Search: The AI Infrastructure You’re Not Paying Attention To - our August analysis of how independent search indexes will become critical AI infrastructure in the SAIO era.