TL;DR

• The Deal: NVIDIA invests $100B in OpenAI to build 10 gigawatts of computing power (4-5 million GPUs)

• The Structure: NVIDIA provides cash, OpenAI spends it buying NVIDIA chips—creating a "circular investment" loop

• Market Response: NVIDIA stock up $170B, but critics question if this is strategy or financial engineering

• Business Impact: Expect faster AI models, higher API costs eventually, and increased vendor concentration

• Strategic Reality: Two companies now control the entire AI stack from chips to models

The AI industry just witnessed its largest infrastructure investment: On September 22, 2025, NVIDIA announced they're investing up to $100 billion in OpenAI to deploy 10 gigawatts of computing capacity. That's not just big money—that's "power 8 million homes" big.

Here's the twist: NVIDIA invests the cash, which OpenAI then spends buying NVIDIA chips. It's like lending someone money to buy your own products, except at a scale that would make entire countries jealous.

The Numbers Don't Lie (But They're Weird)

Wall Street ate this up. NVIDIA jumped 4%, adding $170 billion in market value. Goldman Sachs called it "additive to everything," while Morgan Stanley bumped their price target to $200. Everyone's bullish on the immediate economics.

But scratch the surface and things get interesting. Each gigawatt deployment costs $50-60 billion total—NVIDIA provides about $10 billion in direct funding but gets back $35+ billion in chip sales. They're essentially pre-paying for guaranteed future revenue.

Gil Luria at DA Davidson called NVIDIA the "investor of last resort," warning it's "not healthy that the only investor willing to fund OpenAI's ambitions at this scale is their chip provider." Bryn Talkington from Requisite Capital Management was more direct: "Nvidia invests $100 billion in OpenAI, which then OpenAI turns back and gives it back to Nvidia."

The investment structure differs from traditional venture funding—NVIDIA takes equity while also securing long-term chip purchase commitments, creating what analysts describe as a "self-fulfilling revenue cycle."

Smart? Definitely. Sustainable? That's the question.

What This Means for Your API Bills

OpenAI currently serves 700 million weekly active users across their APIs and ChatGPT. This partnership gives them computational breathing room, but it doesn't solve the underlying economics of AI inference.

Right now, you're getting subsidized API access. Based on industry analysis of AI infrastructure costs versus current pricing, major AI companies likely operate at losses on API requests to maintain competitive pricing and market share. The 10-gigawatt deployment starting in late 2026 using NVIDIA's Vera Rubin platform will provide massive scale, but someone has to pay for it eventually.

My prediction: API pricing will shift upward as the true cost of this infrastructure gets passed through. The current race-to-the-bottom on pricing only works while everyone's fighting for market position. Once the infrastructure investments this size need to generate returns, prices follow.

AMD, Intel, and Everyone Else Just Got Schooled

The competitive responses have been... quiet. AMD was building their own OpenAI relationship—Lisa Su appeared with Sam Altman at AMD's AI event talking up MI400 series deployments. That partnership now looks pretty small next to 10 gigawatts of NVIDIA silicon.

Intel's in a weird spot. They just took a $5 billion investment from NVIDIA days before this announcement. Former CEO Pat Gelsinger (now at startup Gloo) surprised everyone by supporting the deal: "The market reaction is wrong, lowering the cost of AI will expand the market."

Google, Microsoft, Amazon—no major public responses yet. But the strategic implications are huge. Microsoft maintains their current partnership arrangement with OpenAI through Azure while OpenAI gets compute resources that dwarf their current capacity. Amazon's $13 billion Anthropic investment suddenly looks like the only real counter-strategy to the NVIDIA-OpenAI axis.

The Concentration Problem

Andre Barlow, who heads antitrust practice at Kelley Drye & Warren and tracks tech competition issues, warned the deal "could potentially lock in NVIDIA's chip monopoly with OpenAI's software lead." That's the real issue here. NVIDIA already controls 84% of the AI chip market as of May 2024. Now they're a major stakeholder in the leading AI model company.

This matters for developers building AI applications. Your technology stack increasingly depends on two companies that are now financially intertwined. NVIDIA controls the computational substrate. OpenAI provides the models everyone builds on. The partnership makes both dependencies deeper.

Enterprises are already hedging. Box CEO Aaron Levie laid out the strategy: "Our whole strategy was to build an abstraction layer that can work across any AI model and any AI vendor... we're built for any amount of flexibility and optionality."

That's smart. Don't bet everything on the NVIDIA-OpenAI stack, no matter how capable it gets.

Infrastructure Reality Check

Ten gigawatts isn't just a big number—it's a fundamental shift in how we think about AI infrastructure. Each gigawatt potentially needs millions of high-bandwidth memory chips. SK Hynix, Samsung, and Micron already have all their 2025 HBM capacity allocated. Samsung's stock jumped 5% just getting NVIDIA certification for HBM3E chips.

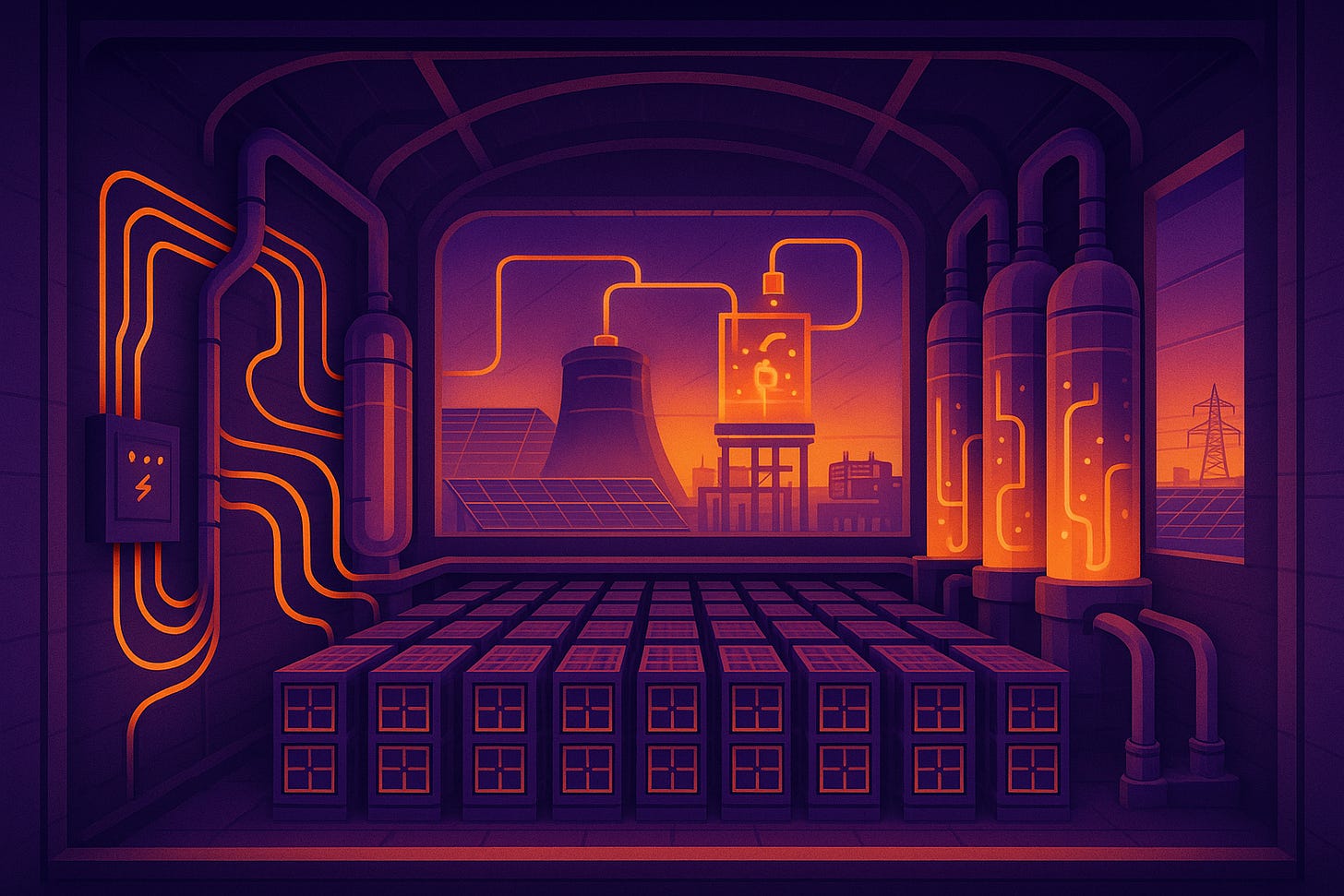

The power requirements mirror data center consumption of entire regions. Deloitte estimates data center electricity use could hit 1,000 terawatt-hours by 2030, nearly doubling from 536 TWh in 2025. The Stargate project plans include solar arrays, battery storage, and small modular reactors.

This isn't just buying more servers. The Stargate project needs dedicated power generation and cooling systems that don't exist yet.

The Developer Ecosystem Shifts

NVIDIA's transition from supplier to major investor changes how the AI development ecosystem works. They're no longer just selling picks and shovels—they own stake in the mine.

For developers, this creates both opportunity and risk. Opportunity: access to unprecedented computational resources through OpenAI's APIs. Risk: deeper dependence on a concentrated ecosystem with aligned financial incentives.

The partnership accelerates custom chip development across the industry. Google's pushing TPUs harder. Amazon's expanding Trainium and Inferentia. Meta's building proprietary processors. But these efforts face the reality that NVIDIA already controls existing infrastructure while becoming a major AI model stakeholder.

Open source alternatives gain importance in this environment. If you're building production AI systems, having options that don't depend on the NVIDIA-OpenAI partnership isn't just smart—it's necessary insurance.

What's Actually Happening Here

Strip away the financial engineering and this deal reveals something important about AI economics. The infrastructure requirements are so massive that traditional venture funding can't scale. The only entities with enough capital are the chip companies themselves.

NVIDIA isn't just investing in OpenAI—they're guaranteeing their own revenue while solving their customer's funding problem. It's brilliant financial architecture that creates a closed loop: NVIDIA capital enables OpenAI growth, which drives NVIDIA chip demand, which generates cash for more investment.

Whether this represents healthy market dynamics or concerning concentration depends on your perspective. For developers, it means the AI landscape will be dominated by fewer, larger players with deeper financial relationships.

The first gigawatt comes online in late 2026. By then, we'll know whether this partnership enables the AI breakthroughs both companies promise or just creates a very expensive oligopoly.

Either way, start planning for a world where AI infrastructure costs real money and vendor choice matters more than ever.

You can find more analysis of agentic AI coding tools and companies at HyperDev.