Amazon’s $25 Billion (and counting) Alexa Bet: Too Little, Too Late?

Can Alexa+ make a difference?

Amazon’s devices division lost over $25 billion between 2017 and 2021. The vast majority of that was due to Alexa—the voice assistant that mostly played music and set timers while hemorrhaging cash.

So when Amazon launched Alexa+ in February 2025—a complete ground-up rebuild with generative AI—expectations ran high. After all, Amazon had been burning roughly $10 billion per year on Alexa as of 2022. Surely this new version would be transformative.

What do reviewers say? “Pretty good.” Not revolutionary. Not game-changing. Just pretty good*. That kind of faint praise might have been fine 18 months ago when Alexa+ was first announced. But today? OpenAI just backed a $6.5 billion hardware venture with Jony Ive, and 2025 forecasts put Google at 92.4 million U.S. voice assistant users to Amazon’s 77.6 million. In a market moving that fast, “pretty good” doesn’t win wars.

(*I will say that I’m a bit more bullish on Alexa+ than some others, because in our household it has become Joanie’s favorite debate partner. Listening to her argue and cajole it to accept her worldview is something else)

What Billions Actually Bought

Amazon truly rebuilt Alexa behind the scenes. The old rule-based system is gone. Alexa+ runs on a multi-model AI routing system (internally mixing Amazon’s new Nova large language models with Anthropic’s Claude) that can pick the best model for each query. Nova’s exact specs aren’t public—one former Alexa scientist claimed the largest model was ~470 billion parameters, though Amazon hasn’t confirmed details.

Custom AZ3 chips in the latest Echo devices deliver about 50% better wake-word detection performance. Alexa+ also has a long-term memory: it remembers household details like dietary preferences, where items are stored, and even which family member is speaking. The system can distinguish individual voices—including young kids with speech delays, according to testers. An “Experts” framework coordinates tens of thousands of services in parallel, and an “Omnisense” sensor platform feeds Alexa+ a 13 MP camera view, audio, ultrasound, Wi-Fi radar, and accelerometer data all at once. Cleverly, Alexa+ often hides any computation lag by speaking while it finishes processing in the background.

And mostly, it works. Early users report Alexa+ handling complex commands like: “Every night at 8:30, start dimming the lights in the house and then lock the doors.” Alexa+ can parse that single sentence into multiple actions and do all of them. Context carries over between queries—you can say, “make it darker in here,” and Alexa knows you mean the lights. One reviewer asked, “What was that song from The Hills? You know, that MTV show?” and Alexa+ correctly responded with “Unwritten” by Natasha Bedingfield (the old Alexa would’ve shrugged).

But…

Leaked Memos Tell Another Story

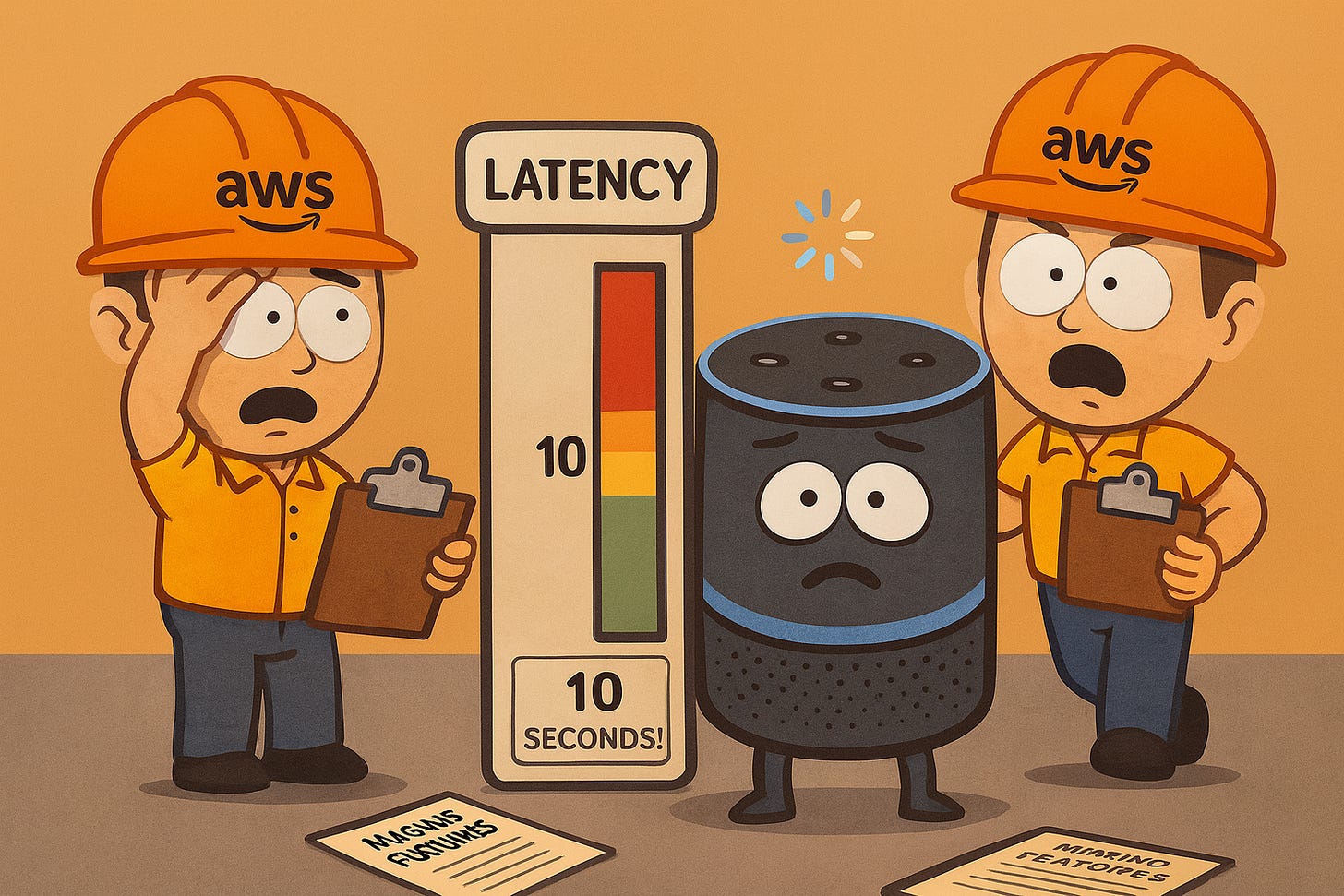

Internal documents from late 2024, reported by Fortune, showed major concerns inside Amazon. Testers gave Alexa+ an average satisfaction score of 4.57 out of 7, missing the 5.5 target. Latency was a “critical issue” – response times hit up to 10 seconds on older Echo devices, well above the 2–4 second goal. Engineers flagged “severe concerns over the latency aspect,” according to one insider. Compatibility was also limited: about 10% of active Echo users (nearly 4 million people) would need hardware upgrades to even run Alexa+ properly.

The much-touted “agentic” commerce skills Amazon promised? Mostly missing at launch. Dining reservations via OpenTable worked, and Alexa+ can call an Uber – but that’s about it. Early testing showed voice ordering through Grubhub simply wasn’t functional. You can’t order groceries by voice yet despite Amazon hyping that feature. There’s no linking of Google or Microsoft email/calendar accounts. Of the roughly 100,000 third-party Alexa skills that existed, only around 300 were upgraded to work at launch. Integration failures were common in testing – attempts to use Uber or OpenTable often timed out. All of this tracks with earlier reporting from 2022–23 that described the Alexa organization as a “division in crisis”, a team that had lost its long-term direction.

Even Fortune‘s own assessment captured the ambivalence: Alexa+ is “vastly superior” to the old version, but “doesn’t blow away voice modes from LLM-based assistants like ChatGPT and Perplexity.” After a year and a half of delays from the original Alexa+ announcement, “pretty good” starts to feel like failure.

OpenAI Just Backed Jony Ive’s Hardware Play

While Amazon was scrambling to fix Alexa+’s latency and integration issues, OpenAI was making a very different move: spending $6.5 billion to jump into consumer devices. In a landmark deal (funded by SoftBank), OpenAI acquired a startup co-founded by Jony Ive—the famed designer of the iPhone—and former Apple hardware chief Tang Tan. It’s not exactly a traditional acquisition so much as a heavily funded partnership to build an “AI-first” hardware device.

The plan, reportedly, is a pocket-sized, screenless, context-aware gadget meant to act as a constant AI companion. Manufacturing is lined up with Luxshare, the same Chinese company that builds Apple’s AirPods and iPhone components. OpenAI is targeting a late 2026 or early 2027 launch for the first product. And CEO Sam Altman has sky-high ambitions: he told staff that OpenAI will “ship 100 million devices faster than any company has ever shipped 100 million of something new before.”

OpenAI has been aggressively hiring Apple’s best engineers to make this happen. In 2025 alone, they poached at least two dozen senior Apple alumni. Their hardware division is now led by Tang Tan, who spent 25 years at Apple and was instrumental in products from the iPhone to Apple Watch. They’ve brought in specialists in human interface design, camera systems, audio engineering, wearables – exactly the expertise you’d need to turn ChatGPT’s AI prowess into a compelling consumer device.

If OpenAI successfully translates ChatGPT’s category-leading intelligence into a must-have gadget, Amazon’s enormous installed base of Alexa devices (over 500 million sold as of early 2023) could suddenly become a liability instead of an asset. Consumers don’t care how many Echos have been sold if a fundamentally better product comes along. Half a billion Echo speakers could end up as under-utilized music players while people flock to a more capable AI assistant built by OpenAI.

Google Leads the Numbers Right Now

Then there’s Google – the current leader in voice assistant usage. In October 2025, Google rolled out Gemini for Home, a next-gen AI upgrade that is replacing Google Assistant on all Nest smart speakers and displays. It’s essentially Google’s answer to Alexa+, powered by Google’s new Gemini AI models. The early access launch was free for existing users, with advanced features gated behind an optional Google Home Premium subscription.

By the numbers, Google was already ahead even before these upgrades. Forecasts for 2025 estimated 92.4 million U.S. Google Assistant users, compared to 87.0 million Siri users and 77.6 million Alexa users. Alexa+ hadn’t moved the needle on that gap yet. There’s no indication those rankings will shuffle in Amazon’s favor anytime soon.

Google simply has structural advantages Amazon can’t match: integration with ubiquitous services like Search, Gmail, Maps, YouTube, Photos; an Android phone ecosystem 3 billion strong; and deep knowledge graphs that make Q&A more accurate. Reviewers who have tried both generally find Google’s new Gemini-based assistant handles complex reasoning and natural conversation better than Alexa+ in head-to-head tests. Voice responses from Google’s system sound more fluid and human. And importantly, Google isn’t digging itself out of a multi-billion-dollar financial hole in this space – it’s building voice AI atop profitable businesses.

Even Apple Can’t Figure This Out

Perhaps most telling of all: Apple, despite its massive advantages, is only middling in the voice assistant race. Siri is forecast to have about 87 million U.S. users in 2025 – billions of Apple devices out there, yet Siri is still just barely ahead of Alexa in users, and well behind Google. Apple’s brand, hardware expertise, and tight ecosystem integration haven’t translated into a winning voice assistant. Siri remains a bit of a punchline in tech circles for its limitations.

Apple even rebranded its AI efforts as “Apple Intelligence” and teased improvements, but so far the features have been modest. The HomePod smart speaker lineup never captured significant market share (Amazon and Google dominate U.S. smart speaker sales). In short, the company that revolutionized smartphones, tablets, and smartwatches still hasn’t cracked the code on voice assistants.

If Apple—with its unlimited R&D budget and hardware/software integration—has struggled to make Siri truly great, what makes Amazon think it can pull ahead? Especially when Alexa+ only lands in the realm of “pretty good” and showed up 18 months late.

The Math Doesn’t Add Up

Amazon’s pricing strategy for Alexa+ hints at the tough economics. Alexa+ costs $19.99/month by itself, but it’s included for free with a $14.99/month Prime membership. In other words, Amazon would much rather you just pay for Prime. That standalone $19.99 price is almost designed to discourage anyone from choosing it over Prime.

Why does that matter? Because serving advanced AI isn’t cheap. Industry estimates suggest each complex Alexa+ query could incur a few cents of cloud computing cost in model inference. If a user asks 10 questions a day, that might be ~$0.20/day – around $6 per month – in pure compute expense. And that’s before factoring in the massive fixed costs of the custom chips, R&D, and overhead. Yet Prime subscribers get Alexa+ “free,” meaning Amazon eats those costs (on top of the free shipping, video, music, and other benefits included with Prime).

a majority of Alexa queries have long been just one of three things: playing music, controlling lights, or setting timers.

Historical context makes this even more daunting. Recall that Alexa and Amazon’s devices unit lost over $25 billion from 2017–2021, and by 2022 it was on pace to lose about $10 billion in that year alone. The grand idea was that voice commerce would pay for everything, but that never materialized. Users mostly stuck to the basic free tasks – music, weather, timers, alarms. In fact, a majority of Alexa queries have long been just one of three things: playing music, controlling lights, or setting timers. As one insider quipped, “we’ve built a smart timer”.

Former CEO Jeff Bezos was so bullish on Alexa’s potential “downstream” value that Amazon used a special “downstream impact” metric to justify the investment – basically crediting Alexa for any shopping people did after using their Echo devices. Current CEO Andy Jassy scrapped that fuzzy metric when he took over and demanded a real path to profitability. Jassy has aggressively cut other experimental projects, and internally he was reportedly privately underwhelmed by what Alexa+ could do at launch (some at Amazon have derided Alexa as little more than an “expensive alarm clock”). Even Jeff Bezos has been getting involved again – CNBC reported that Bezos has been emailing execs to ask why more AI startups are choosing rivals’ services instead of Amazon’s.

Facing those realities, Amazon paints Alexa+ as an indispensable part of its broader strategy: a voice-first future where the smart home and shopping converge. Maybe Alexa+ makes Prime more sticky. Maybe people will finally start buying things by voice. Maybe it keeps Amazon relevant in an AI-driven future. But those are maybes, not guarantees.

Three Scenarios for 2026–2027

Scenario 1: Amazon locks down the home. The bet here is that Amazon’s household footprint and Prime ecosystem form a moat. Alexa+ continues to improve (especially with Amazon’s partnership and investment in Anthropic’s AI). It becomes the central hub of an ambient smart home, tightly integrated with shopping and entertainment. Prime bundling means most customers can use Alexa+ at no obvious extra cost, removing friction. And although OpenAI or Google might offer cool personal devices, the hassle of switching your whole home setup (lights, doorbells, TVs, etc.) away from Alexa keeps many consumers in Amazon’s camp. In this future, voice-first ambient computing beats mobile-centric AI for how people actually use assistants day-to-day.

Scenario 2: OpenAI’s personal AI trumps all. This is the vision Sam Altman & Jony Ive are gunning for: a new category of personal AI device that renders the home speaker model less relevant. If OpenAI’s device (and any copycats it spawns) is truly useful everywhere you go – a sort of AI in your pocket or on your lapel – then having an AI only in fixed locations (kitchen counter, living room) could feel limiting. An AI that knows you (because you carry it everywhere) might serve you better than one attached to a shared home hub. In this scenario, Amazon’s half-billion Echo device advantage might evaporate, because the battle moves to a different playing field (mobile and wearable hardware). Alexa+ could stagnate back into what the original Alexa was: a decent music player and home automation tool that isn’t central to people’s lives.

Scenario 3: Google’s knowledge wins. Google might simply out-innovate here by doing what it’s best at – information and integration. If voice assistants become less about executing purchases and more about knowing things and handling complex requests, Google’s superior data and AI might maintain an edge. Gemini for Home could steadily outshine Alexa+ on intelligence and accuracy. Google can also leverage its presence on every Android phone and a huge portion of cars (Android Auto) to push its assistant everywhere. Amazon, lacking a phone platform, is stuck in the home and some wearables. In this future, voice AI is just an extension of general AI and search engines – domains where Google (and OpenAI/Microsoft) have a lead – rather than a shopping interface where Amazon is strongest.

All three scenarios have plausible arguments. Amazon does have real strengths: a huge install base, a robust developer ecosystem for Alexa skills, retail integrations, and a proven willingness to spend heavily to gain market share. But the competitive landscape features rivals with equally strong (or stronger) tech credentials and entrenched platforms of their own. Alexa is no longer the only game in town like it was in 2015–2016.

What This Actually Means

Alexa+ was a necessary move for Amazon, but not a sufficient one on its own. Amazon correctly recognized that conversational AI is an existential threat to an assistant like Alexa. They invested billions to re-tool Alexa with state-of-the-art generative AI and custom silicon. By many measures, the engineering feat is impressive: multi-modal large language models, low-latency on-device processing, advanced voice recognition and personalization, etc. Alexa+ is far more capable than its predecessor – more conversational, better at complex tasks, richer in context memory. Amazon’s spokesperson even noted that users “love having natural, free-flowing conversations with Alexa” now.

However, “pretty good” technology in a market that demands greatness is a perilous position. The AI quality gap between Alexa+ and leaders like ChatGPT/Gemini is still noticeable. Crucial features Amazon advertised didn’t ship at launch. And the business model remains shaky – essentially subsidized by other parts of Amazon in hopes of indirect benefits. With the devices division’s past losses over $25 billion and roughly $10 billion annual burn rate as of a couple years ago, Alexa+ needs to start justifying its existence in tangible ways.

There are some early positive signals. Amazon told The Verge that by June 2025, over 1 million users had gained access to Alexa+ (up from only a few hundred thousand a month prior). Among those early adopters, engagement with Alexa (number of requests, etc.) was roughly double what it was with classic Alexa, indicating the new capabilities are getting used more heavily. This suggests that when Alexa+ is available, people (like Joanie definitely!) do find it more useful than the old version.

Yet the fact that Alexa+ launched with so many missing pieces – no voice grocery ordering, no email/calendar integration, many skills offline – implies the product was pushed out under competitive pressure rather than delivered fully ready. Amazon needed to show progress in AI, so it shipped Alexa+ in “early access” and is patching the holes in real time.

Amazon’s vision of an ambient, voice-first future still has promise. They have significant assets: tens of millions of households with Echo devices, a thriving e-commerce platform that Alexa can tie into, and the Prime ecosystem to bundle services. Alexa+ could absolutely carve out a dominant role if Amazon executes flawlessly and faster than its rivals. But that’s a big if. OpenAI’s entry and Google’s resurgence mean Amazon is now fighting on multiple fronts against world-class AI competitors. Those competitors aren’t burdened by Alexa’s legacy or business model constraints.

The bottom line: Alexa+ is good technology that represents a huge step forward for Amazon, but it’s arriving in a market where “good” might not be enough. Amazon has little margin for error after the time and money it has sunk into Alexa. The next 18–24 months will determine if Alexa+ can grow beyond pretty good to truly great – and whether Amazon can leverage its distribution advantage before the likes of OpenAI and Google out-innovate or outmaneuver it. For Amazon, which has already spent tens of billions to stake its claim in voice AI, the stakes have never been higher.

Ultimately, Alexa+ isn’t just a new product launch – it’s a bet that Amazon can finally turn its voice assistant from a costly curiosity into a cornerstone of the next era of computing. If “pretty good” doesn’t evolve into “world-class” soon, Alexa may go down as one of the most expensive missed opportunities in tech history.

I’m Bob Matsuoka, writing about AI, technology strategy, and market dynamics at HyperDev. For more on tech giants and platform shifts, read my analysis of Google 2025 and Microsoft 2010: The Incumbent’s Curse or my take on AI Power Rankings: Market Intelligence for Business Leaders.